Will the rise of the superapp model and more deeply embedded banking usher in new levels of democratized access to financial services and further our quest toward full financial inclusion?

The future of finance is embedded

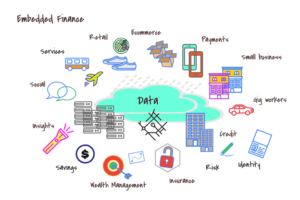

When we think about banking today, we see more and more examples of how banking as a function has started to disappear. Within the world of financial services, venture capital driven fintech startups, and large technology platforms, we like to say that banking is becoming embedded. Embedded simply means being surrounded by another function or feature. One can now imagine a world where nearly every aspect of traditional banking can simply be an invisible feature of another industry’s product or service experience.

Welcome to the age of embedded finance.

It is truly a fascinating development to see for an industry that has made tremendous profit on being very present, in both the tangible and intangible aspects of our financial lives. With the advent and decade-long trend toward the unbundling of financial services from payments to credit to wealth management, it is interesting to see the march of both open banking and embedded banking to further loosen banking’s grip on its global customer base.

Will the rise of the superapp model and more deeply embedded banking usher in new levels of democratized access to financial services and further the quest toward full financial inclusion?

As the facets of financial services become increasingly cut apart, we must look back for clues about where we are headed next — and where the biggest opportunities are to serve the financial needs of more people. Do you remember what banking used to be like? There was a time not too long ago when most primary functions we did with any financial services brand were bundled together in a single relationship. This fusion of day-to-day banking, savings, credit, and often investments, was tied to a physical bank branch, and often a single person or small group, who acted as our personal banker. Banking was something we did at a particular place and at very distinct times. And its evolution toward the industry we know today really started with the introduction of consumer payments.

As the industry expanded its digital footprint into credit cards, ATM cards, installment loans, and more electronic options to store, move, and access money, banking became much more mobile and less reliant on physical currency and paper checks. Jumping forward several decades with the introduction of voice banking, online banking, and mobile banking — accelerated by the introduction of the truly smart phone in 2007 — banking’s level of convenience and expansion in the use of technologies like APIs, AI/ML, and cloud computing are among the many reasons banking is being widely upended. A model once full of friction has become truly frictionless.

As traditional banking services are becoming a utility, developers can now simply drop the code of any banking activity — from onboarding and identity to payments to credit to investment — directly into their application workflow and make banking itself fade to the background. New business models have emerged, among them the superapps of several large technology firms throughout China and Southeast Asia, that allow consumers and small businesses to combine day-to-day life needs and business functions into one single application.

Will this be the new global model?

This change in dynamics allows businesses to move the focus from simply conducting transactions toward building more long-term relationships. As we move further into digital experiences, the next decade will be even more compelling as consumers continue to demand more convenient functionality and frictionless experiences. The ability to be at the right place at the right time — supporting consumers and retailers alike — where they want, how they want it, and when they want it — cannot be understated.

Nor can the symbiotic relationship that develops between consumers and businesses that are focused on a similar goal — connectivity and alignment. Consumers and users of the superapps want to combine the convenience of having all of their financial and non-financial needs met in one place, and businesses look to solidify more committed customers as part of their focus on growth. In the interim, people’s financial well-being improves as their goals start to align with the companies they interact with. This flexibility and alignment, offered by the likes of superapps that are so prevalent in Asia, starts with transactional connectivity.

In the digital finance world of Alipay, for example, payments are merely the pipes — and a means to an end, empowering the digital lives of over 1.2 billion everyday consumers through everything from food delivery, transportation, entertainment, and digital finance, among other services. This is all fueled by an ecosystem of data and connectivity designed to improve their customer’s daily lives.

The role of the platform, with its abundance of data, is becoming increasingly crucial in a growing economy heavily reliant on small and micro businesses, long an underserved segment of the market. As demand for credit, investment, and insurance grows, the platform can assess risks, streamline and deploy personalized experiences, and leverage insights facilitated by a hyper-connected ecosystem.

Such business models also empower those who were not previously included in the formal financial services industry, as evidenced by Grab’s success story: An estimated 1.7 million microentrepreneurs open their first bank account with Grab since 2012, and 1 in 70 people in Southeast Asia has earned income through the Grab platform — one that has been successfully transformed from its humble beginnings as an online taxi booking service to a powerful ecosystem that includes ride hailing, food delivery, loans, insurance, payments, and investments.

Remember what Bill Gates said in 1994? “Banking is necessary, banks are not.”

Imagine the platform as a physical machine, where every user behavior, purchase, and interaction, feeding the algorithms, fine-tuning every decision made, and generating petabytes of data centered around real time human connectivity. Through this data, there is now the capacity to offer personalization and optimization on a scale never seen before. But what does this look like in practice? How can the machine enhance financial well-being, starting with money movement?

When we think about how money moves today, the global machine of disjointed systems is far from optimized. Part of this is because the machine isn’t truly connected in the way that we think. Sure, like how data flows through the interconnected system of the internet, the pipes that move money are certainly connected, but the value of the information running through it isn’t optimized for our consumption. It seems logical then that a connected system of money movement mapped to the daily lives and activities of consumers and businesses would perform the more important task of truly meeting wants and needs. And what happens when that centralized engine learns to optimize our finances?

That’s what we are seeing today with the super app platforms in the East, each one creating a perpetual learning machine designed to meet the needs of multiple parties at once, all while learning from itself on how to perform that task better. We are only witnessing the very beginning — a long march into the disappearance of financial services.

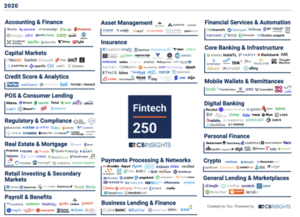

What happens when nearly every function that CB Insights identifies as the Fintech 250 is rolled into one application powered by a centralized engine? What happens when the goals of these companies are wrapped up into a single entity, their needs no longer dictated by a multitude of shareholders and venture-backed investors? What happens when the viewpoint and purview of all of these companies are brought into one view? This makes the future much more compelling.

Source: CB Insights

Source: CB Insights

So where will we go from here? How will the model of embedded finance evolve — from the U.S. (e.g. Amazon, Apple, and Facebook) to India (e.g. Whatsapp, Paytm, and PhonePe), and Latin America (e.g. Movile, Nubank, and Rappi), where will we see the most promise? This is where embedded finance gets interesting. When you combine the functionality of the superapp — the ability to understand and learn from the daily experiences of more than a billion people using the app every day — you start to align more longer term goals with daily activities.

By analyzing daily spend, you have the ability to better facilitate savings and investments, to help build additional wealth over the long term. As you enable just in time infusions of credit, you create new opportunities for businesses to quickly meet the changing needs of their customers. As you connect real time consumer behavior to the small and medium sized businesses that can fulfill them, you are creating a flywheel of impact on the financial lives of everyone.

This is the promise of embedded finance. As banking becomes more ambient, the pure profit motive of banks changes. While the superapp model connects buyer and seller, consumer and business, it connects the goals of each and creates a machine of perpetual motion toward more inclusive business practices that can improve the human condition. This is why removing the historical business model of financial services from the physical act of banking is an imperative. This is the path toward global financial inclusion that goes beyond access, that goes beyond the existing paradigm, that moves the industry forward.

The promise of embedded banking is in the shifting focus of the financial services business model from the profitability of the banking provider to the long-term financial wellness of the consumer and business provider. The goals of any one company should not be more paramount than one that betters the community, that improves society as a whole.

Join us on September 1, 2021 99:00 am PT) as we explore this evolving model for the future of financial services, register now for FTT Embedded Finance North America.

_________

By Theodora Lau & Bradley Leimer of Unconventional Ventures

Unconventional Ventures helps drive innovation to improve systematic financial wellness. We connect founders to funders, provide mentorship to entrepreneurs, strategic advisory services to a broad set of corporates, and broaden opportunities for diversity within the ecosystem. Our belief is that anyone with great ideas should have a chance to succeed and every voice should be heard. Visit unconventionalventures.com to learn how you can partner with us today.