Digital lending has been one of the key areas of focus in the digitalisation efforts of financial service providers during recent years, with Covid 19 accelerating it further and at an unprecedented pace. It is estimated that the digital lending platform market will account for $15.3 billion by 2026, up from $3.5 billion in 2018.[1]

With that, many lenders still struggle with building digital lending systems and transforming their lending operations, and consequently extract limited value from the technology investment in terms of efficiency, profitability and scalability. As an alternative asset manager focusing on Financial Services, we’ve been experiencing these challenges from different parts of the spectrum – both as investors in mainstream and alternative lending businesses that have been transforming to digital lending, and as a credit provider to specialist non-bank lenders across SME, real estate, consumers and more. Our direct experience with our portfolio companies, as well as a partner to other lenders, teaches us some valuable lessons about the dos and don’ts of achieving optimal results.

Humans?

I discovered Netflix during the pandemic, and more specifically Humans – a fascinating series about a world with synthetic robots that develop consciousness. As someone who automates financial services for living, I can’t stop thinking about the point we won’t need humans in financial services anymore… Interestingly, in the series a synth submits a loan application to a human credit officer…

Perhaps the alternate title of this blog should really be “do we need humans’ involvement in digital lending”? and my short answer would be – temporarily yes, but with a friendly recommendation to every product manager and BA, to ask themselves this question in every step of the process of designing, building and implementing a new digital lending system. And they should have a very good answer to it considering the available data, automation tools and software (no-code, modelling, back-end, etc.) tools that exist in the market today.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Starting from the end

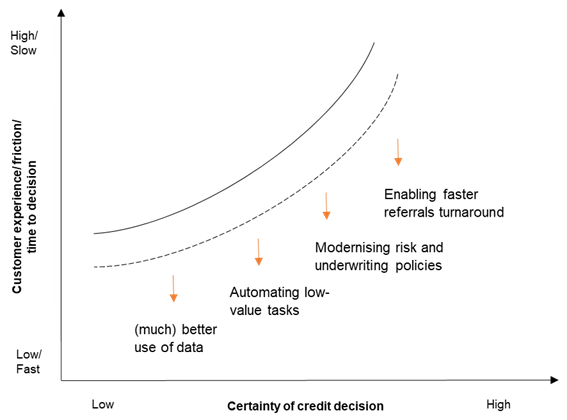

The following chart encapsulates the essence of digital lending and key factors that influence the end state of the technology and operating model:

Essentially, building a truly digital lending system comes down to finding the optimal trade-off between:

- What underwriters really need to know to underwrite a loan, and more specifically:

- which datapoints underwriters need to compile the customer risk profile and take a decision?

- what analysis (metrics, KPIs, models/ scorecards) is being done over the data in the decision process?

- what is the decision process/ tree(s)?

- and most importantly – which decisions can’t be automated? In other words, which branches (end-cases) in the underwriting decision-tree must be taken manually due to complexity and required judgement?

and

- Customer experience – how the required data from the borrower throughout the application and underwriting processes is captured in the most frictionless way – i.e., minimising the number of touch points with the borrower during the application and underwriting processes.

In other words, a good digital lending system should enable the:

- Borrower – to experience as frictionless as possible application and underwriting process. Optimally, the applicant should be asked to provide only the minimal set of identifiers and consent to access certain data sources (where needed), and

- Lender – to automatically compile a rich customer (borrower) profile that would allow them to automate most of the credit decisions/ tasks in the decision tree and minimise the turnaround time for referrals. That said, in contrast to the commonly held belief, the real win in digital lending systems is the speed of processing referrals, rather than fully automated decisions – i.e., turning the many hours/ days/ weeks of underwriting (manually processing referrals) into a few minutes of working with a smart dashboard that surfaces the referral triggers that require manual intervention/ decision.

What’s gone wrong

Experienced product or project managers (PMs) who follow the above should be able to successfully build and/ or implement a modern digital lending system. Still, too many lenders get it wrong and struggle to achieve the expected objective from the tech investment. Why?

- PMs don’t (or can’t) challenge business processes and policies– I mentioned in another blog that digital transformation in Financial Services can go as far as the business’ approach to risk and the risk function’s ability to evolve. The common mistake in lending transformation programs is to let the PMs “play around the edges” – by mirroring with tech the existing analogue methods, rather than using technology to tackle the core issues of archaic underwriting and risk methods and policies. It is the difference between digitation to digital transformation

- The auto-decisioning fallacy – another common mistake is to focus the system design, technology and KPIs on auto-decisioning. Auto-decisioning is one component of digital lending, that usually (except for small ticket consumer loans) accounts for ~ 50%-60% of origination volume, usually for the smaller ticket or more straight-forward applications. Going back to the previous point about underwriting and risk policies, the real value of digital lending would be the turnaround time of referrals, that can’t be fully auto-decisioned. That’s where the value of a digital lending lies – the underwriter’s ability to analyse and decide about the triggers to those referrals at a fraction of the time it took previously, in a much smarter and consistent way. In turn, it creates an iterative process that should result in further automation as the policies and methods to address those referrals evolve

- CROs, policy makers and product managers need to be open minded to the potential of data – The transition from analogue to digital lending means that traditional interactions with customers are replaced with data and analytics. It requires PMs and risk functions to really understand the existing spectrum of data sources and how to automatically compile a rich customer profile. It’s a critical prerequisite to design a truly digital lending system, and the working assumption must be that the data does exist. Yet, the reality is that many PMs and risk functions don’t meet this prerequisite, and as a result struggle to transform underwriting and risk methods. And to put it in the right context, by understanding data I’m not referring to big data or exotic data sources, but rather to (to begin with) understanding the thousands of data points available from credit bureaus, different public registers, and consent-based data sources like Open Banking, trading data, etc.

- The data fallacy – in our fast-moving digital world, data is considered “the new oil”. True for those who can turn oil into fuel, rather than drowning in it… Simply put, when the exponential growth of different, rich data sources and the availability of that data is not used to automate or augment faster and smarter decisions, the abundance of data adds complexity and confusion, and ultimately translates into more manual work

- Shooting the arrow and marking the target around it – designing a new system around a (pre-selected) vendor, and by that compromising processes/ data sources/ other capabilities to align with the selected vendor

- Crashing during the implementation/ change landing – failing to implement the new system due to (one or more) poor EX, inadequate change management and insufficient training/ support. Interestingly, such crashes are correlated with poor service design and/ or business processes re-engineering. Both result in increased complexity/ poor user adoption as would increase (rather than reduce) work to the end user.

Taking a closer look

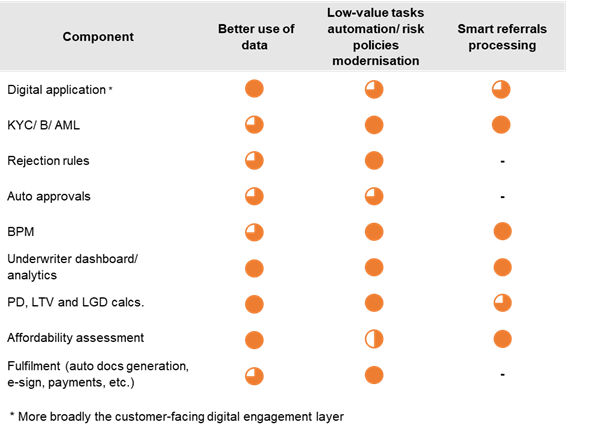

Digital lending systems would usually have different versions of key technical/ functional components to:

- allow customers to apply digitally

- automate the data capturing and decision processes to various degrees

- allow underwriters to manually process the rest

In addition, such systems would usually have modern LMS/ back-end systems.

Another way to understand the failure points and success factors, would be to breakdown the digital lending system into its key components, and assess the impact of each factor on the overall outcome/ KPIs – e.g., average time-to-yes, conversion/ approval rates, cost-to-serve, etc.

The following table outlines the key components of a digital lending system and expected impact of the key drivers (above) on the contribution of each component to the overall outcome:

A more detailed analysis of the above table, and how to maximise the impact of each component on the overall outcome should be covered in a separate blog, but for now I would say that the two key takeaways from the above table are:

- Tech isn’t an issue – while most (if not all) of the technologies in the stack are commodities, the real impact on KPIs is driven by (tech enabled) process optimisation/ re-engineering and progressive risk/ governance methods. In other words, the make or break is about how the tech is applied to underpin smarter methods and processes, and

- Tech build and vendor selection – should be done through the lens of enabling the business to apply those key drivers, to maximise the impact on the overall outcome. It means that the design of a digital lending system should start with a service design/ future operating model, that tech should enable.

Embedded Lending

Embedded Lending – the notion of delivering digital, frictionless financial services via APIs at the point-of-need, is intriguing. It takes the unbundling-rebundling dynamic a step further by pushing the traditional boundaries of financial services.

With that, Embedded Lending is based on the assumption that the required data* to underwrite a loan can be captured/ provided by the primary service provider before or at the point of need and turn into a near-instant decision by the (embedded) lending partner. The concept is great, the reality is still trying to catch up… hence, still focused on the lower hanging fruits of lending products.

As Embedded Lending providers expand and target the more complex lending products, the points above will apply, exponentially. In turn, they could (and probably would) become the front runner and address those challenges in new and very innovative ways.

* Including under regulatory requirements e.g., affordability assessment

Do we really need humans’ involvement in digital lending?

Probably, yes, but mainly due to pace of tech adoption in businesses and some limitations technology still has. That said, between Embedded Lending, the advancements in RPA/ AI, Digital ID and Open Finance, to the increasing “leadership’s digitalisation” in financial institutions, the assumption should be that the reality will look completely different in 5-10 years.

Written by Gilad Amir, Pollen Capital

P.S. The next edition of FTT Embedded Finance & Super-Apps taking place in London on 13th May 2025 and live as part of the FTT Fintech Festival on 11th – 12th November 2024 at The Brewery, London.