The financial services business model has changed significantly during the past decade, as have the solutions that consumers leverage to manage their financial lives. Around the world, we are seeing more examples of how banking services have started to merge into non-financial applications. Unbundling is slowly changing the way financial services are delivered and consumed, allowing us to reimagine where financial services can be served and distributed, at locations where consumers engage with rather than being herded to bank branches, apps, and financial institutions’ websites.

A world where nearly every aspect of traditional banking can simply be an invisible feature of another industry’s customer experience.

Welcome to the age of embedded finance.

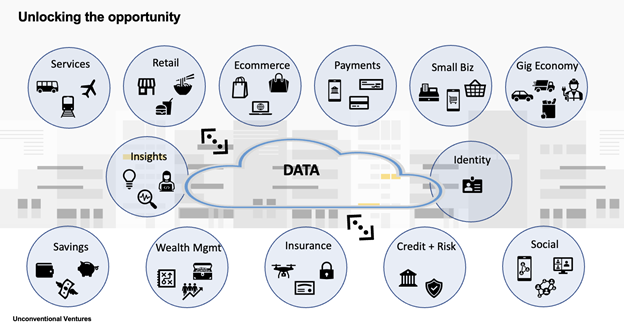

As the facets of financial services have become increasingly cut apart over the past decade, we look for clues about where the industry is headed next — and where the biggest opportunities are for banks and credit unions to continue to serve the financial needs of their communities. In this new era of open finance, how can financial institutions iterate on their business model?

It starts with understanding changes in human behavior in regard to how they bank.

How do customers and small business owners make payments today? Where do they save their money? How do they access credit? How do they manage their wealth? Where do they get their advice? Are they increasingly being asked to manage portions of their financial lives through applications outside of the incumbent financial institutions?

As the (now) old phrase goes — there’s an app for that.

Even during this pandemic, consumers are holding static funds within service applications like Starbucks, Stash, and Robinhood, sending money via Venmo, Apple Pay, Square Cash, and tying more of their spending into subscription services like Netflix, Hulu, and Disney+. They are also receiving (and accepting) credit offers through the web and mobile from companies like Hopper (for travel fintech), and PayPal (for Buy Now, Pay Later).

What does this mean for traditional banks and credit unions, for their business model, and for their relationship with their clients? Perhaps, Railsbank captures it best as their core mission: “Make embedded finance into apps and customer journeys as simple as Drag and Drop.”

Will relationships with banks become a replaceable feature? As the value of financial relationships change, as consumers continue to demand more convenient functionality and frictionless experiences regardless of the source, how will the banking business model be disrupted?

The ability to be at the right place at the right time — supporting consumers and their changing needs — cannot be understated. This business model goes far beyond simple digital transformation.

Banking as a utility has evolved in markets around the world and spells further competition:

- Companies in China and Southeast Asia offer aspiring models for Amazon, Facebook, and other big technology firms. In China, Tencent combines a network of consumer services, small business fulfilment, and finance in one powerful superapp. Alibaba and their spin off Ant Group offer payments, savings, investments, credit, credit ratings, and insurance, negating the need for an overlaying banking relationship from multiple parties. In Southeast Asia, an ecosystem of 11 countries and 670 million people, where 6 in 10 people are either unbanked or underbanked, both Grab and Gojek have seen tremendous success building a one-stop-shop platform layered with financing capabilities for consumers, drivers, and merchants.

- In Europe, open banking data and payment standards established by Payments Services Directive 1 and 2 have created requirements for large banks to provide secure real time transactional data backend capabilities for technology providers and fintech startups to access and build value on top of. And the model to enable consumers to “obtain financial services whenever, and wherever they need them” is gaining steam with recognizable brands. Recently, the UK retail giant John Lewis has teamed up with digital wealth manager Nutmeg to launch three retail investment products focused on ESG. It will be interesting to see how often people will think about investing while they are shopping for sheets and china.

- In the United States, different models have also been developed, including Stripe Treasury, which enables merchants and vendors to make ACH and wire transfers through Stripe’s banking partners, in addition to access to interest-bearing bank accounts and faster access to payments. Shopify, for instance, can now customize their Shopify Balance for their merchants, providing them with a one-stop-shop to manage their funds, pay bills, and track expenses. And of course, we are all very familiar with the Buy Now, Pay Later feature, which has enabled various high-profile partnerships between fintech startups and retailers.

As our ecosystem continues to evolve with customer lifestyle and technology improvements, financial institutions must develop ways to engage the benefit of other products and services alongside the trust created of their own.

Data is the key ingredient at the heart of the future business model of financial services. This is also the promise of embedded finance.

As banking becomes more ambient, leading financial institutions will embed themselves within the heart of their financial relationships — regardless of where they reside — in order to create new opportunities based on trust and the flexibility to grow into this new normal.

By Theodora Lau & Bradley Leimer of Unconventional Ventures

P.S. The next edition of FTT Embedded Finance & Super-Apps taking place in London on 13th May 2025 and live as part of the FTT Fintech Festival on 11th – 12th November 2024 at The Brewery, London.